Drive Speed and Accuracy In Catastrophe-Related Underwriting Moratoriums

The proliferation of natural disasters during 2021 and for the past several years has created some thorny issues for insurance company underwriters. As large-scale events, such as wildfires, hurricanes, earthquakes, and floods unfold, they need to suspend insurance underwriting new policies in areas affected by the disasters.

Historically, these decisions have been made manually based on readily available information such as media reports that aren’t necessarily backed by science. For instance, underwriting moratoriums for hurricanes may rely on traditional “in the box” approaches: when the eye of the storm enters a pre-defined “box” with a certain strength, insurance underwriting moratoriums are issued for that area. No policy coverage can be bound while the storm is “in the box.”

Unfortunately, with multiple events often occurring simultaneously in different areas, the manual process not only can be painstakingly slow, but may be subject to significant inaccuracies. For carriers, the risks of such errors typically involve implementing the moratorium over too large an area.

Notably, when that happens, there may be a significant lost business opportunity.

Today, however, various disaster models for all types of catastrophic events can be integrated with automated underwriting programs to drive greater accuracy in moratorium decision-making, giving carriers a better way forward. With advancements in hurricane forecasting, it is possible to obtain the probability of winds exceeding hurricane force at a single location up to five days in advance. These probabilities, which result from running hundreds of possible scenarios, are already conservative as they’re intended for life safety.

Thus, underwriters can assess the probability of an account being impacted by an impending hurricane well in advance and set or lift moratoriums on an account-by-account basis. Of course, there’s still judgment involved based on an insurers level of conservatism. Nonetheless, the final decision will leverage the best scientific models in real time, leading to fewer missed opportunities.

During the past two years, as several major hurricanes were projected to make landfall, insurance underwriting managers were able to customize their moratoriums based on forecast wind speed probability thresholds. Forecasts were updated frequently as the event unfolded, helping underwriting teams make sure they continually optimized the area covered by the moratorium.

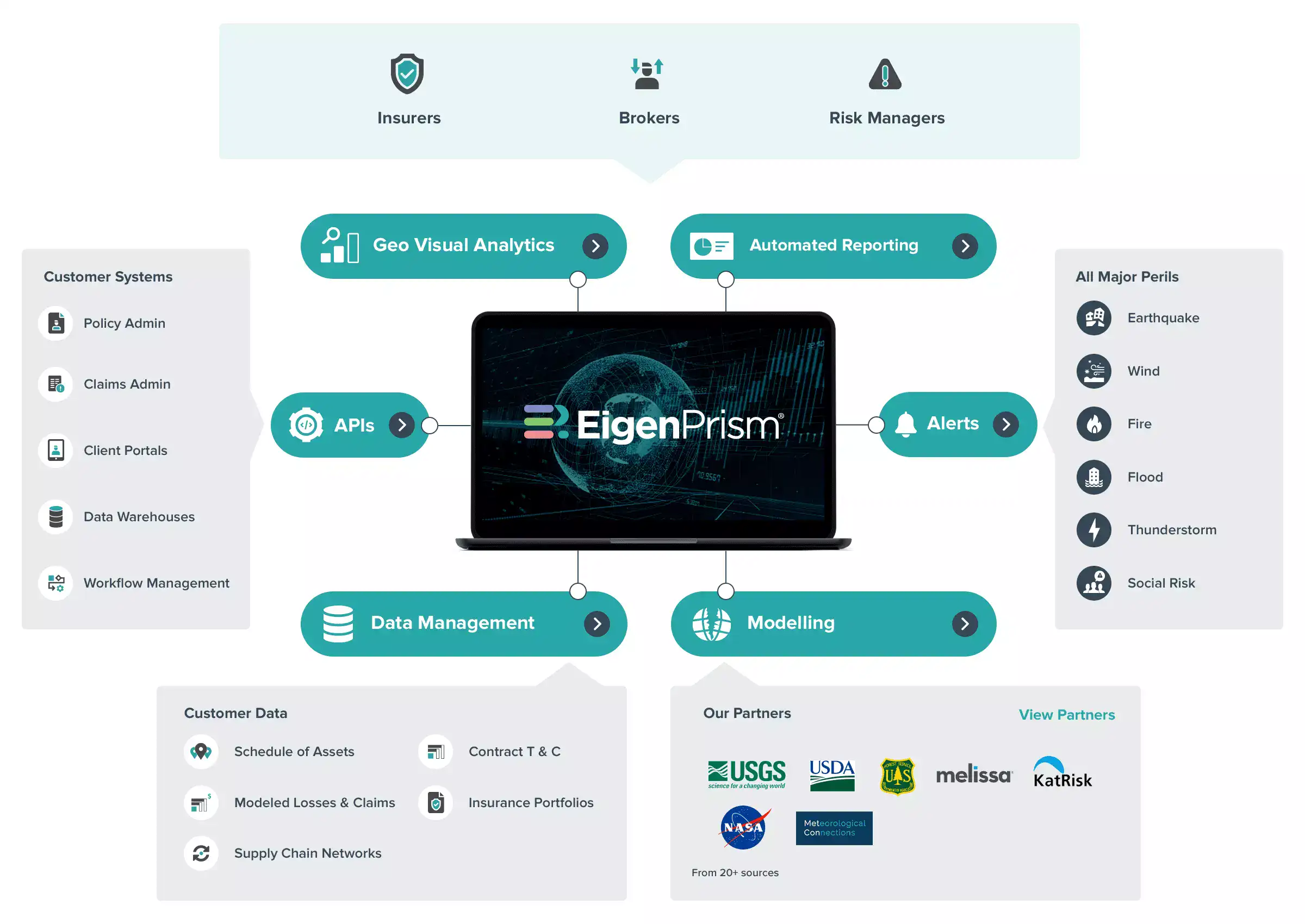

As an example, consider Vave, an algorithmic MGA owned by the Canopius Group (a global specialty re/insurer with underwriting operations in the U.K, U.S, Australia, Bermuda, Netherlands and Singapore). Vave offers a suite of API services that enables brokers to access U.S. property products electronically and bind and service them in real time.

Its challenge, however, involved managing the potential impact of catastrophes.

The insurer subsequently was able to integrate real-time catastrophe event notifications and analytics into the technology and Vave’s automated underwriting process. This enabled it to automate the process of issuing underwriting moratoriums during a catastrophe in Vave and ensure that underwriting resumed post-event – entirely without manual intervention.

Thus, through the API, notifications for natural catastrophe events were integrated directly into the Vave platform. When catastrophes triggered certain thresholds, underwriting was automatically suspended in that region.

During a 12-month period, 5,410 cat event notifications were processed and 938 alerts regarding events potentially impacting the Vave portfolio were delivered to the underwriting platform through the API. The event notifications covered earthquake, wildfire, flood, hail, and tropical cyclones, ensuring the Vave underwriting platform was able to make appropriate business decisions as natural catastrophe events were forecast and occurred.

Significantly, by integrating Vave’s platform with a catastrophe analytics firm that could quickly process shape files from different weather and natural catastrophe event data feeds, Vave was able to fully automate what otherwise would have taken hours or days to do manually.