UNCOVERING AND ADDRESSING YOUR CATASTROPHE RISK BLIND SPOTS

With large-scale catastrophic events occurring both more frequently and with greater severity, the time is right for insurers to assess of how effectively they are navigating this elevated risk environment. When it comes to managing their catastrophe exposures, insurers are often focused on optimizing their pricing and capacity using sophisticated probabilistic models.

Indeed, many insurers have invested heavily in resources (Ph.D.’s, IT teams) around processes to embed these models into underwriting and exposure management. Yet, they continue to have surprise losses (e.g., multiple losses modeled as 1000-year events happening within only a few years).

While such events may not be preventable, they still can be anticipated – and related losses may be mitigated – provided insurers are aware of inherent “blind spots,” in their risk assessment processes which traditional models have not addressed. These blind spots include:

NON-MODELED EVENTS:

Consider the Texas freeze of 2022, for which no models existed at the time – or even now for this type of “black swan” event. In addition, the 2018 Camp Fire, the deadliest and most destructive wildfire in U.S. history, was another non-modeled occurrence. Today, as wildfire activity spreads in Canada, California and other areas, wildfire models still have difficulty with fire spread through built-up environments.

MODEL “MISS”:

This was the case with the extensive flooding produced by Hurricane Harvey. At the time, hurricane models did not anticipate the risk of severe flooding due to “wet hurricanes,” but since then we’re seeing more of these types of events as hurricanes carry more moisture due to climate conditions. Many models do incorporate this now, but such events are still more likely to cause surprise losses.

LOSS-SIZING UNCERTAINTY:

In the aftermath of large-scale catastrophic events, it can weeks or months, to obtain credible impact estimates that are critical to accurate reserving and timely claims response.

OUTSIZED UNDERWRITING MORATORIUMS:

Some insurers spend more than 70 days each year in some type of moratorium due to the frequency of hurricane, flood, wildfire, severe convective storm and other events. When coupled with overly conservative criteria for such moratoriums, this results in significant opportunity cost.

Why Are There Blind Spots?

The first step for insurers to avoid or work around blind spots involves understanding what’s behind them. First and foremost, there’s generally been an over-reliance on “industry standard” models for all kinds of decision-making related to catastrophe exposures and events. Yet, these models have several limitations:

- Fit for purpose: For the most part, catastrophe models were designed for probabilistic modeling “in the aggregate.” While they have been proven effective for supporting pricing decisions, they don’t work quite as well for other business purposes requiring location-level detail or more deterministic decisions.

- Data quality issues: Any model is only as effective as the data input. In many cases, data, such as property values, location, and COPE are inaccurate, leading to costly miscalculations, erroneous projections, and inadequate responses.

- Inherent uncertainty: Even with the best data, the output of any model still involves some level of uncertainty, which is too often overlooked by decision-makers relying on the output.

- Climate change: Many models have been calibrated based on historical data; yet, given the effects of climate change, those assumptions are no longer credible.

- Lengthy run times: Even with the latest advances in technology, running many models typically involves a manual, time-consuming process to generate and interpret actionable results. Given the speed with which many events unfold, these delays can lead to inadequately supported decisions and poor results.

Addressing Blind Spots

Although one approach to overcome blind spots might be to explore more or better models, the more prudent course of action may be to step back and try to simplify how you’re dealing with catastrophe events. Here are six measures to help with this process:

- Get a complete and accurate understanding your exposure: Take a closer look at your data and try to improve data quality. To this end, even basic geo-visualization can uncover data quality issues that often may be hidden in spreadsheets and databases.

- Review your aggregate risk: Go back and carefully assess your exposure accumulations without the “noise” of frequency and severity assumptions. You’re less likely to be surprised by non-modeled events if you’ve done the groundwork to make sure you’re not overexposed in any specific region or zone.

- Run deterministic scenarios: “What-if” exercises take frequency out of the equation (which adds the most uncertainty) and make it easier to plan for what are more likely to be “credible worst-case” scenarios.

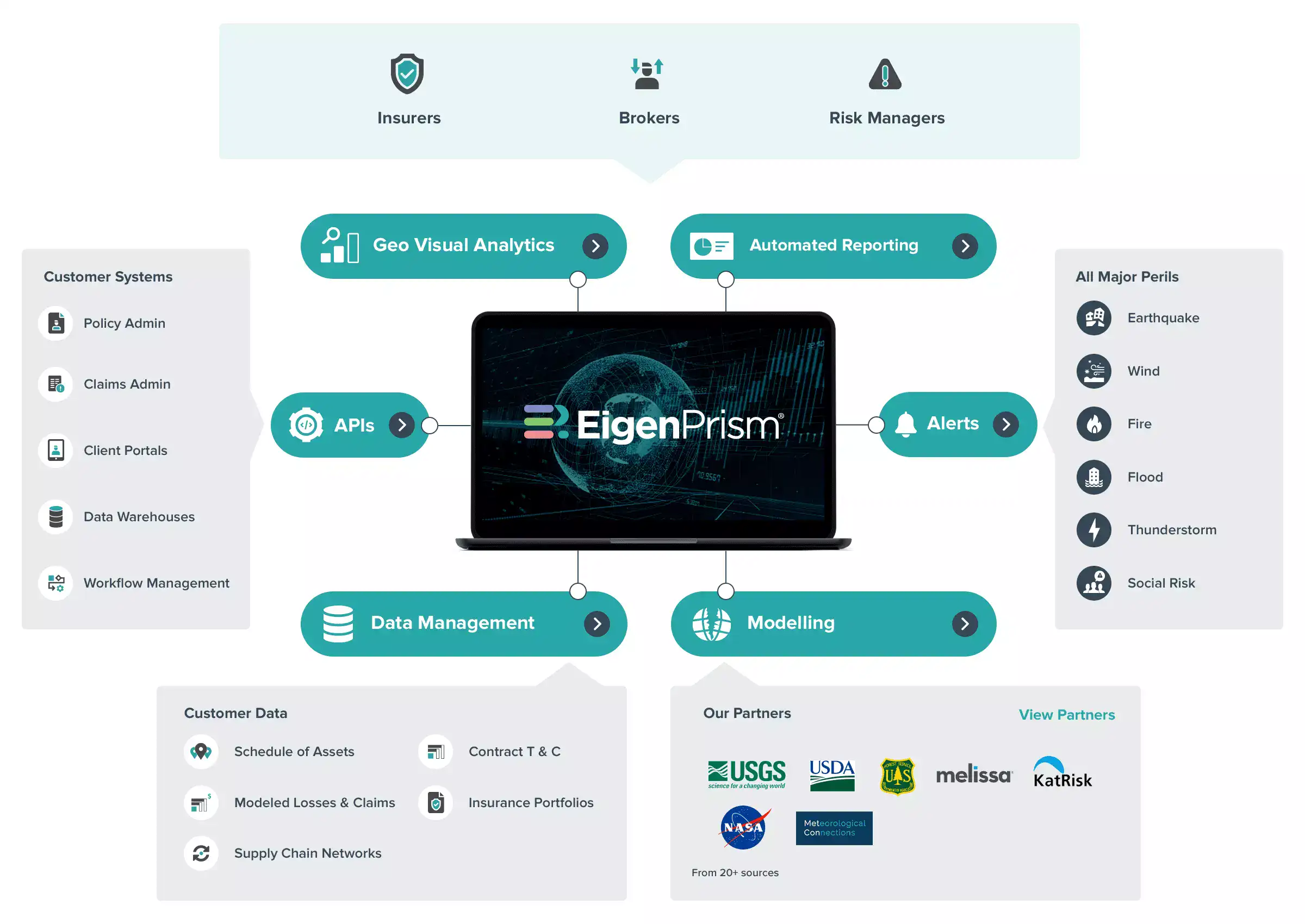

- Focus on available real-time analytics: Leverage the best analytics to improve your response to live events. For instance, using high-resolution event footprints and imagery can provide far more accurate loss estimates than working backwards from probabilistic models, which were not designed for such estimation.

- Monitor event updates to adjust moratoriums: Underwriters can also establish smarter underwriting moratoriums by using regularly updated forecasts at the highest granularity available. That way, you can be open for business when competitors are shut down.

- Enhance customer service by sharing real-time event analytics: Engage your policyholders proactively by using targeted and actionable alerts of unfolding events that might impact their properties. That’s delivering value when it often matters most to insureds, instead of just waiting for claims to come in.

When events occur, using the best available analytics tools and resources will enable you to generate more accurate loss estimates for tighter reserving and more confident communication to stakeholders.

With elevated catastrophe exposures a somber reality for carriers and their insureds, the ability to eliminate and work around blind spots can result in smarter decision-making, better preparation and response, stronger customer relationships, and better overall performance.