Putting Art into the Science of Underwriting

The client, an underwriting agency, part of a leading US insurance brokerage firm, is a premier leader in personal lines program underwriting and distribution, specializing in catastrophe-prone markets. By utilizing advanced analytics and taking a data-centric approach, the client consistently delivers superior results.

The Challenge: To Accelerate Data Insights Delivery For Swift Underwriting and Rating Decisions

The client team created a data-centric approach to underwriting and rating by developing an accumulation monitoring system to manage capacity at a granular level, using accumulation concentrations. With over a 100,000 accumulations to manage in Florida alone, by early 2022, they realized they needed a faster way to absorb accumulation level data insights into underwriting and rating decisions.

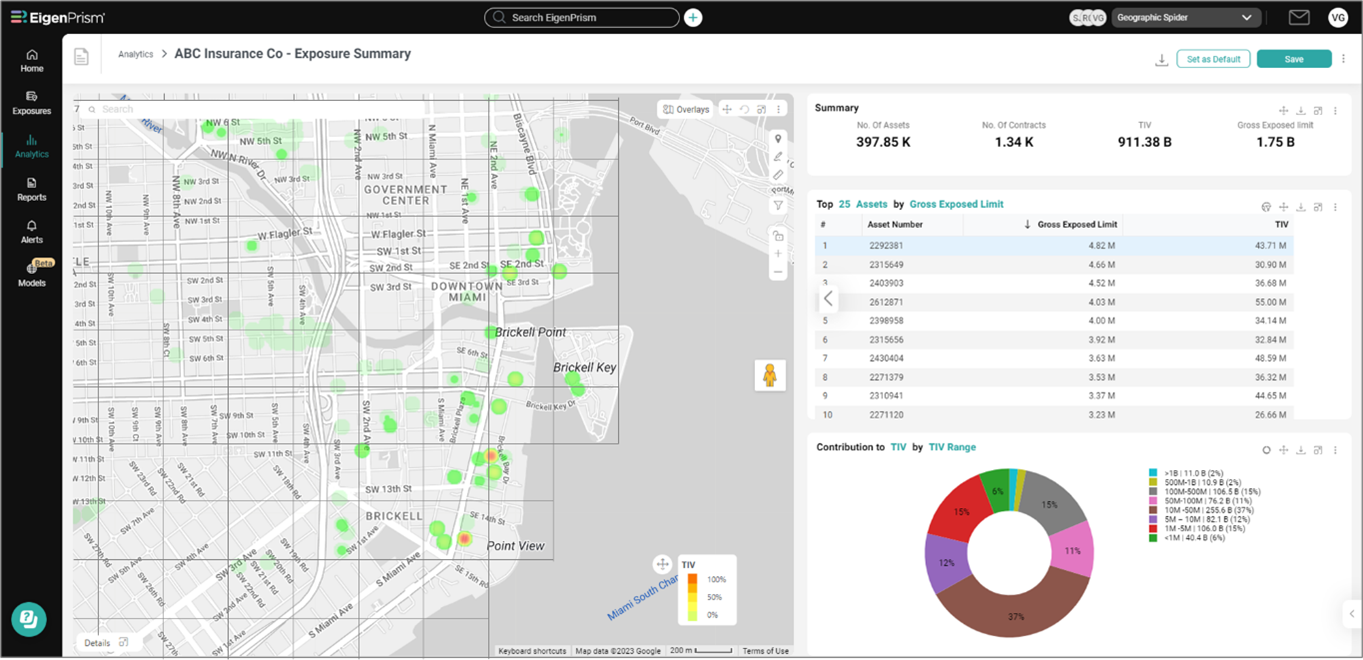

- Intuitive Analytics: The accumulations allowed policy data to be managed at a granular level but, it required manual efforts to review hundreds of thousands of rows of data. Visualization of the portfolio, with overlays, would enable both underwriters and risk managers to a) immediately identify and drill down into concentrations at the portfolio level, and then to specific properties, reducing a week’s worth of manual analysis by multiple analysts and b) track key performance metrics at portfolio and accumulation concentration levels. Ultimately, the goal was to not only visualize the portfolio but to also enable the team to make underwriting and rating decisions quickly.

- Interactive Carrier Access: Granting partners with online access to their portfolios and performance metrics at the accumulation level, the client could deliver unparalleled transparency to their carrier and reinsurer partners – a critical differentiator in a competitive market. In addition, during catastrophic events, the client wanted a faster way to deliver impact estimates to reinsurers.

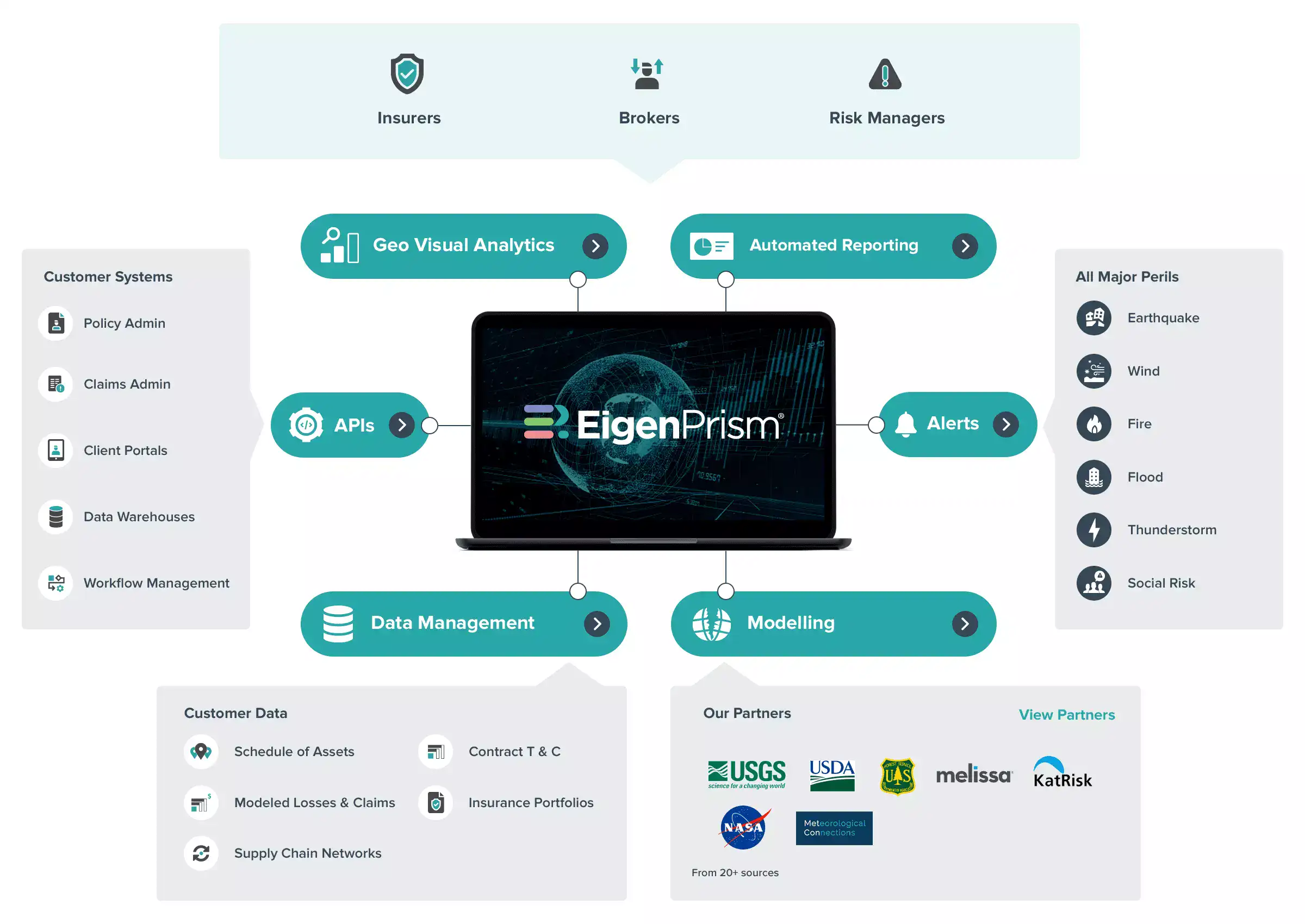

The Solution: EigenPrism’s Analytics and Sharing Framework

In May 2022, the solution was implemented: EigenPrism risk management platform. The portfolio can now be fully visualized with the accumulation concentration overlay, and with the ability to see individual property level detail. This combination allows data insights to flow into underwriting and risk management business processes faster than ever.

Through the EigenPrism sharing framework, the carriers now have access to their own dedicated online workspace and can securely view their positions at any time – an important, and unique, advantage.

Through the EigenPrism sharing framework, the carriers now have access to their own dedicated online workspace and can securely view their positions at any time – an important, and unique, advantage.

Business Impact: Delivering Underwriting Excellence

The client team monitors capacity utilization, by accumulation concentration, and uses that information to reallocate underwriting capacity on a weekly basis. Previously, this reallocation exercise would take months.

With respect to improving impact estimates to carriers and reinsurers, in the days following Hurricane Ian, the client provided each carrier with an event report detailing the impact for their policies by accumulation concentration to validate claims, provide insights to risk management, and indicate future pricing.

The client now takes full advantage of its proprietary accumulation monitoring solution. Technology enables intuition and visualization “puts art into the science of underwriting”. They can now deliver underwriting excellence that responds not just to industry challenges, but to longer-term shifts in technology, the economy, climate, and consumer preferences.