EigenRisk® launches new version of Catastrophe Risk Platform, integrating traditional models with Climate Change Impact

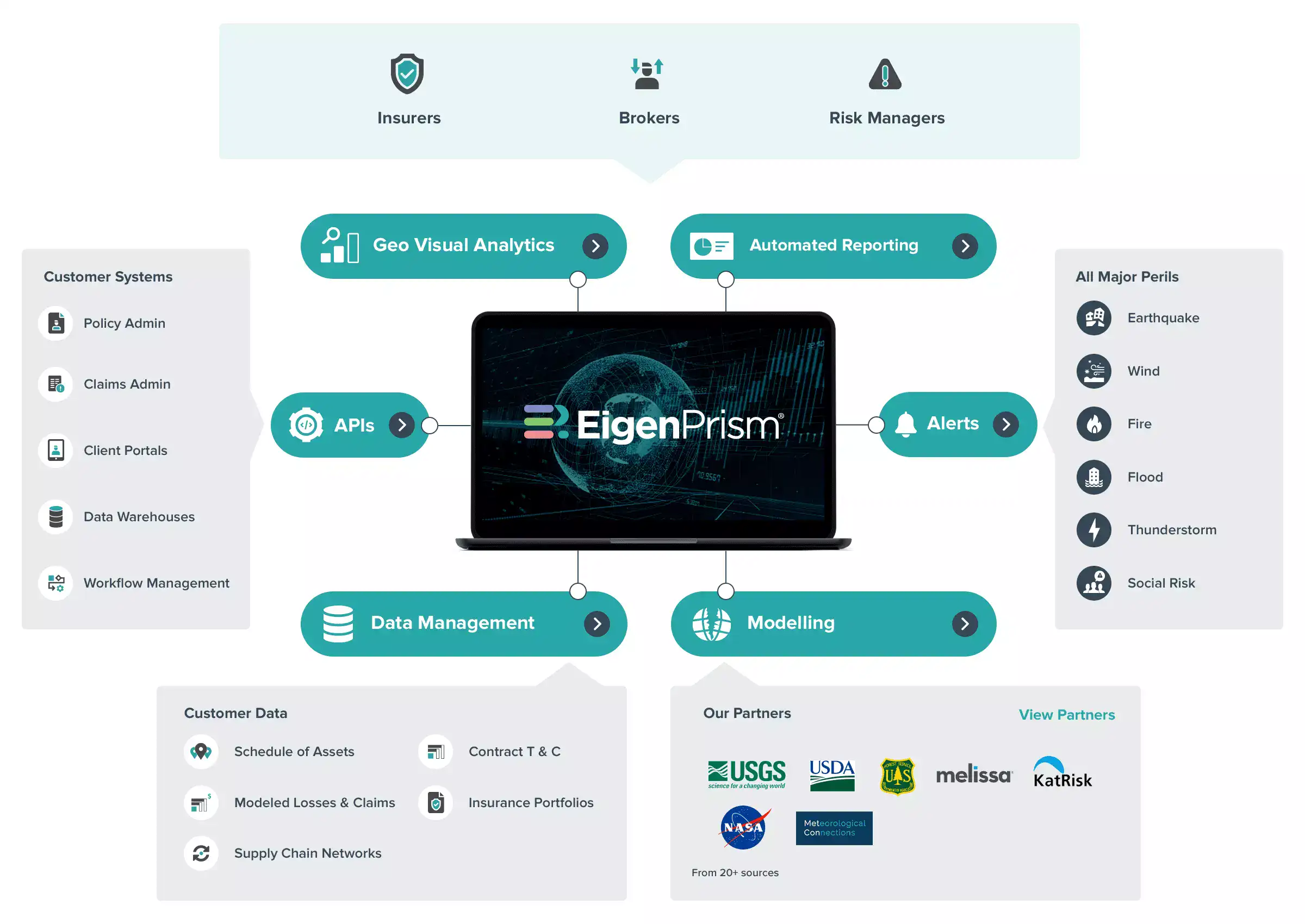

ANN ARBOR, September 21, 2022 – EigenRisk® today announced the launch of a new version of its catastrophe risk management platform that integrates traditional catastrophe modeling capabilities with climate change impact analysis. The upgraded capability, available on version 4.0 of the platform, provides access to new tools and resources that enable insurers, reinsurers, and risk managers to adjust their catastrophe underwriting, risk and response planning for the impact of climate change

With catastrophic weather events becoming more frequent and severe in recent years, property insurers, reinsurers and risk management executives need new solutions to help them plan for, manage and respond to an evolving global risk environment. By using a combination of traditional models and climate change impact assessment tools, they will be able to understand and manage potential exposures faster and more effectively.

-Deepak Badoni, President | EigenRisk® Inc.

According to EigenRisk, traditional catastrophe models, which have been widely used for more than three decades, typically focus on shorter (typically one-year) time horizons and are primarily targeted to insurance pricing and annual exposure modeling. While their output has become increasingly granular, their results are driven by historical frequency and severity experience which has become less reliable given the proliferation of “surprise events” arising from climate change.

Meantime, climate change impact assessment is an emerging field of science, which focuses on 10- to 30-year time horizons that are more suitable for long-term strategic planning and meeting new regulatory requirements. Although these new assessments are global in scope, they tend to be lower resolution than traditional models.

“The convergence of these two approaches on our platform gives users the best of both worlds and enhances their ability to assess exposures with greater accuracy and confidence,” Badoni added. “Our vision is to provide the most complete solution to manage catastrophe and climate risk anywhere in the world and we’re continuing to expand the resources on our platform to make that happen.”

Version 4.0 of EigenRisk’s open platform includes access to best-of-breed catastrophe models, such as those from KatRisk for integrated flood, wind, and surge modeling, that are able to incorporate climate change variables. With this release, EigenRisk has added a new suite of long-term models to improve coverage of different perils, including drought, heat stress, fire weather stress, precipitation stress, and sea level rise from such sources as World Resources Institute (WRI), Copernicus, and NOAA. Used in conjunction with the one-click reporting capability in EigenPrism 4.0, users can quickly generate actionable insights for different RCP climate scenarios.

EigenRisk is continuing to build on its climate change offerings to address new perils and scenarios around the world.

# # #

About EigenRisk®

EigenRisk, Inc., an independent insurance technology firm, helps (re)insurers, brokers and risk managers across the globe manage catastrophe risk, and drive higher growth, customer engagement and operational efficiency. The firm’s cloud-based platform provides one-stop access to powerful data management, geo-visualization, analytics, reporting, modeling, alerts and APIs. These capabilities are integrated with hazard data, event projections and simulations curated from more than 20 leading public and private sources to provide a more dynamic and complete perspective of risk. Visit www.eigenrisk.com.