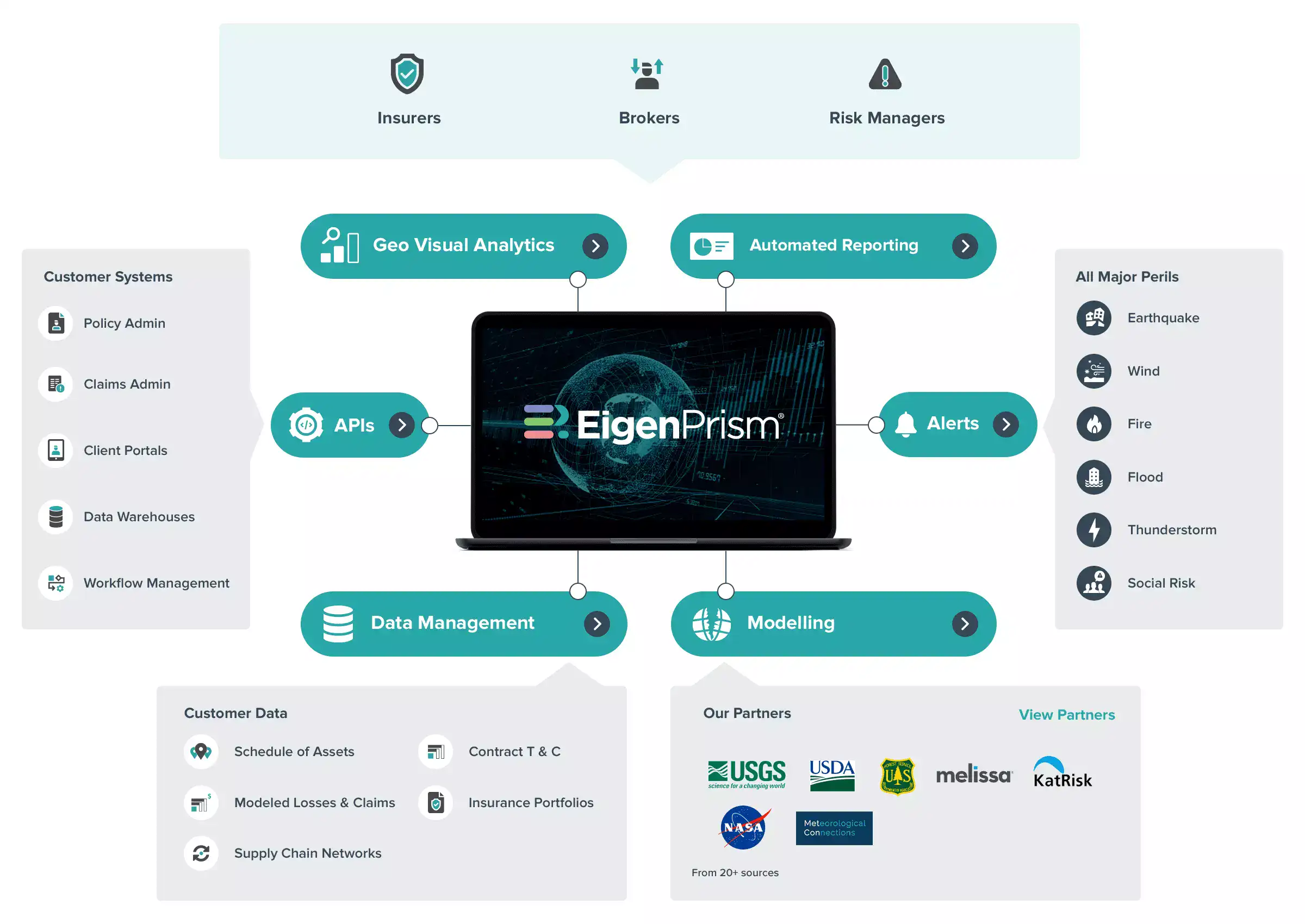

The Technology-Driven Property Insurance Broker

Technology has the ability to enhance property brokers’ services by allowing them to be more strategic, and spend less time on zero value-added tasks and more time on advising. Let’s look at how technology can support the four key functions in a broker role.

1. Collecting Property Data:

Technology can streamline how you manage client data. Import disparate data formats into a standardized format stored in a platform, keep data current over time as values change, and analyze it to find data quality issues.

2. Assessing Exposure:

Analytics can help you assess exposure more accurately in your clients’ portfolios. Be able to pinpoint potential hazards with a higher degree of confidence.

3. Structuring the program:

Data visualization tools can allow you to design an insurance program faster and with more confidence. Identify potential gaps and overlaps in program layers and shares, reducing costly errors and omissions. Testing the insurance program by applying financial modeling techniques to stress test layers and shares is a new function enabled by tech.

4. Managing the program:

Get timely alerts during live natural catastrophes with early warnings and estimated impacts. Have more ways to engage and delight your clients throughout the year to improve client retention.

In each of these processes, technology can greatly enhance the property broker function by automating transactional tasks or giving insight into property risks that weren’t available previously.

To see how a technology-driven property insurance broker function, download our ebook for brokers: