Cutting Through The “Noise” Surrounding Insurtech Catastrophe And Climate Risk Management Tools

Given the widespread impacts of various types of natural catastrophes on their property portfolios, insurance executives have been engaged in a relentless search for tools and resources to enhance their catastrophic risk underwriting capabilities, event response and claims management.

For these executives, there’s both good news and bad news.

The good news: There are now numerous new solutions available with a wide range of enhanced capabilities.

The bad news: The proliferation of these new resources has made it increasingly difficult to differentiate one from the other and to choose those best suited to your needs and the capabilities and acumen of your underwriting, exposure management and claims teams.

Here are some ways to cut through the noise surrounding the myriad of technology-driven solutions now available to help manage catastrophe and climate risk in the marketplace today:

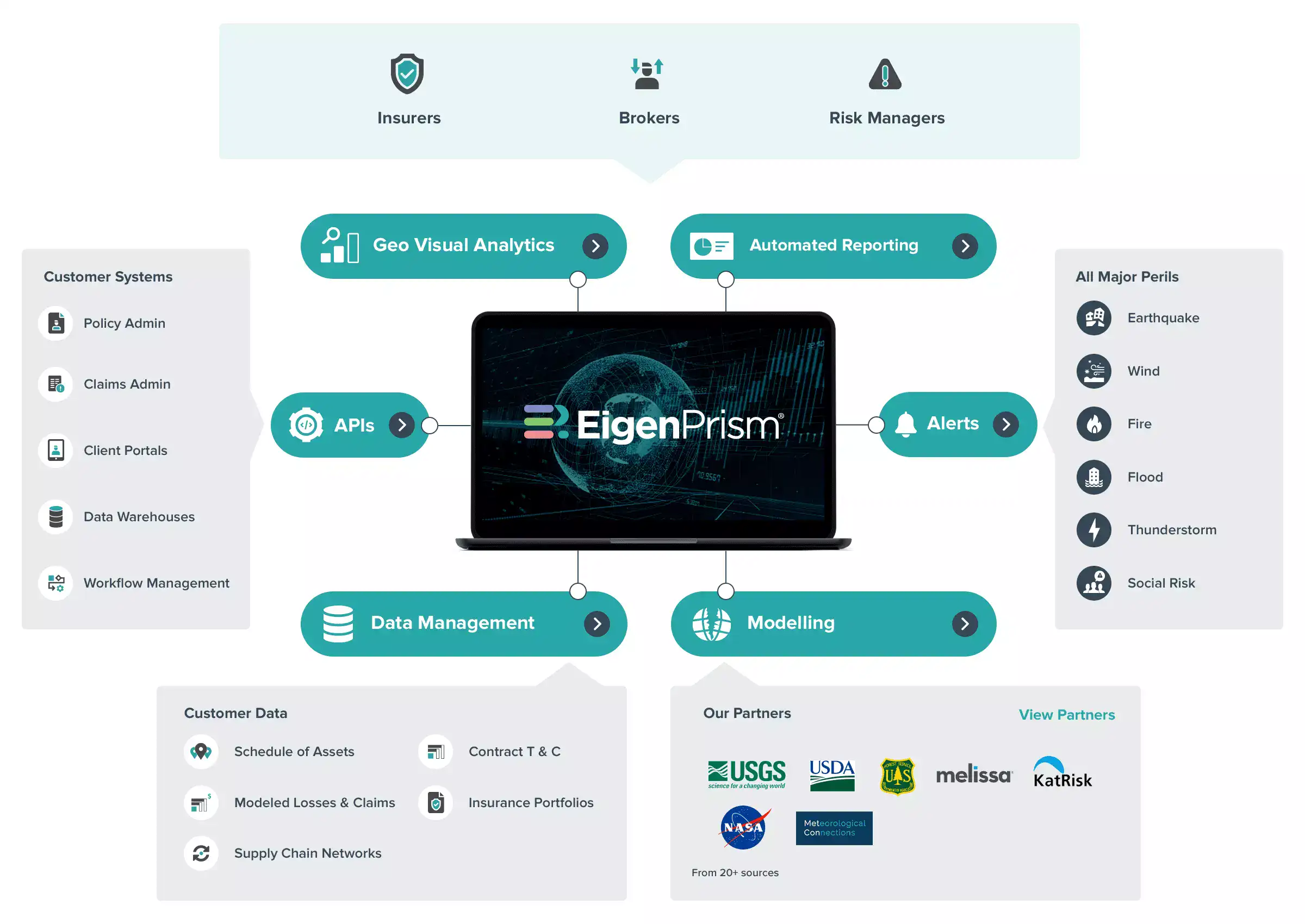

- Identify the right category- Make sure the solution aligns with your current and anticipated future needs and that you are comparing apples to apples. Does the vendor provide new datasets/imagery, or is it software that helps you manage and segment your data? Is it a model or a real-time alerting solution? Does it provide business intelligence or other analytics? Which perils does it cover? Is it limited to specific geographies?

- Determine the true cost of ownership- While some solutions are essentially plug and play, others may require significant investment in time and resources for full implementation. They may call for extensive involvement of IT as well as training of end users because interfaces aren’t intuitive. Furthermore, consider that deploying several different one-off solutions for specific perils may also mean you’re absorbing significant overhead costs, which can add up if you need to address multiple perils or geographies.

- Consider the advantages of more integrated platforms- Many of these providers already have several different solutions available on a single platform, which helps keep costs down and makes it easier for users to move seamlessly from one set of tools to another through a standard interface. These platforms also can quickly add state-of-the-art resources as they become available and offer end-to-end workflows which enable users to get results faster, and with fewer steps, and without having to switch between tools.

- Leverage API capabilities- Look for systems with advanced application programming interfaces, which can help end users avoid “tool proliferation” and readily integrate with different sources, saving users valuable time and increasing adoption.

- Don’t overlook checking a provider’s data security credential- When sharing your sensitive data, make sure your provider has implemented state-of-the-art security will maintain the integrity of your and your clients’ data and keep your protected from the rising wave of cybercrime.

As the entire field of insurtech catastrophe and climate modelling and analytics continues to advance at a rapid pace with the benefit of increasingly sophisticated technology, insurance executives have a widening range of options to enhance their related underwriting, exposure management and claims management capabilities. By carefully assessing their immediate and longer term needs and conducting a thorough evaluation of all available options, they will be in position to make informed decisions that deliver the results they want.

# # #