Settling the Score: Assessing the Perils of Over-Simplified Climate Risk Analytics

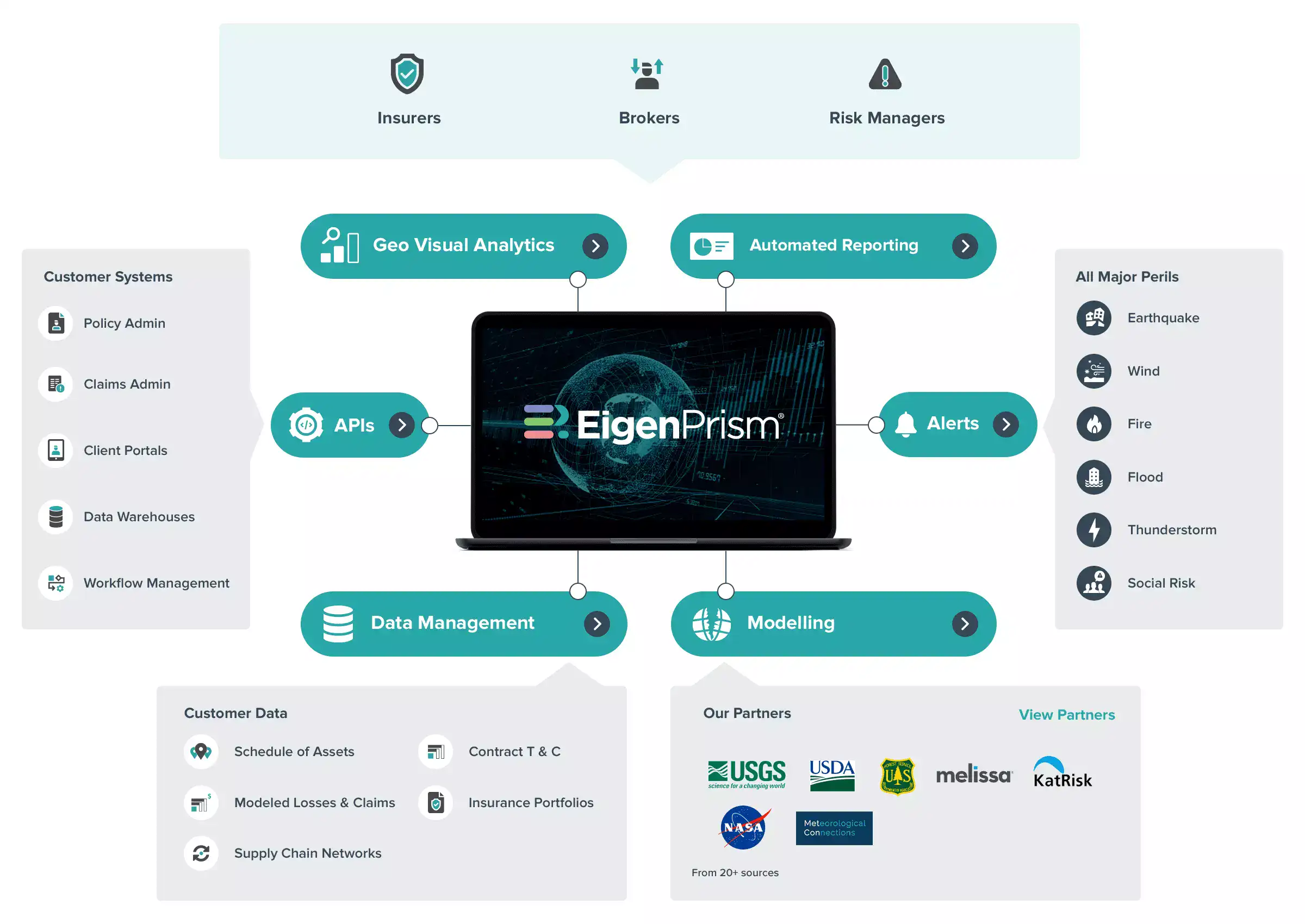

With the arrival of the peak months of the 2022 Atlantic Hurricane Season, along with numerous wildfires, tornadoes and large-scale flood events, Property Underwriters and Risk Managers are eagerly seeking more robust analytics to evaluate their climate-related exposure.

Although there’s no shortage of new solutions to address the need for Climate Risk Analytics, buyers should beware of any efforts to oversimplify the analysis of these extremely complex and multifaceted risks.

As Albert Einstein presciently noted:

Everything should be made as simple as possible, but not simpler

What’s become all too commonplace today is the well-intentioned attempt by many risk modelers to pare sophisticated analytics into simple “scores” (such as ratings of 1-10) for individual locations with respect to various natural hazards – from tornado, hail, and flood to heat stress and wildfire.

Often, the different scores are shown side-by-side in visually compelling charts to convey a sense of relativity for risk and insurance executives who may not have the time to dive into the incredibly sophisticated modeling process that typically happens behind the scenes.

Yet, over-simplifying such analytics can often be a disservice to end users because it removes vital context. For example, how does a score of 9 for tornado relate to a 6 for wildfire? Chances are these two very different scores have not been normalized. In fact, as a practical matter, they can’t easily be normalized across different peril, once you begin to consider frequency, severity, damageability and all other variables in play.

“Checking the box” vs. informed decision-making:

While these scores might be useful in “checking the box” for compliance purposes, they are not actionable for most business decisions.

So, what’s the alternative? There are well-known actionable metrics, ranging from simple to complex, that can be used instead of scores.

For instance, with respect to tornadoes, you can use the frequency of tornadoes in the vicinity of a location. Thus, property underwriters and risk managers can make more informed decisions knowing that there has been an average of five recorded tornadoes within 25 miles of a location rather than merely trying to understand the impact of score of 9. The first is a fact; the second is a subjective judgment on which any two people (or experts) could disagree.

Similarly, flood depths at different return periods provide a more “visual” representation of the risk in context of how likely these will be exceeded. Thus, while it may seem difficult to assess risks related to a 5-foot flood depth with a 1 in 100 chance of being exceeded in any year, that probability is far more actionable than a score of 7/10 for the same location. The former enables you to correlate flood depth to the height of your first floor above ground and quickly gain some intuition to your true risk.

For the most complete analysis incorporating as many variables as possible, probabilistic models offer AALs (Average annual loss) and PMLs (Probable Maximum Loss) for a specific location which consider the specific building characteristics and value. But keep in mind the inherent uncertainty that comes with all the “precision” that goes into the models. Precision does not necessarily equate to accuracy, and you may unwittingly be reducing accuracy unless you are careful to avoid “garbage-in garbage-out” modeling.

Regardless of the type of analysis you choose, given the substantial potential exposures associated with these different catastrophic events, it’s important to invest the time to understand the resulting metrics; they contain valuable information needed for informed decision-making. And keep in mind that any attempts to distill these metrics down to a single “score” for a location will involve necessary assumptions and introduce subjectivity.

Finally, if you must use a score, because that’s the only metric available to you, then try to understand the basis for the score. Does it represent the frequency, severity or combination of both?

Ultimately, this exercise is no different than learning a new skill. And climate change is a big enough and ubiquitous problem, that it is time for underwriters, risk managers, and other business decision-makers to up their game.