Accurate Valuations First Step in Preventing Financial Disaster

With the 2024 Atlantic Hurricane Season Approaching, Now’s The Time to Double-Check Commercial Property Values

Even as supply chain backlogs of some building materials have eased in recent weeks, risk management executives still must be concerned about the impact of inflation on their property values and whether their insurance is sufficient to address what are likely to be elevated replacement costs.

From flooding to tornadoes, convective storms, hurricanes, and wildfires, the litany of catastrophic events to strike various parts of the U.S. in recent months should be a wake-up call that no property is immune from the potential impact of a widespread natural disaster, let alone the ever-present risk of an isolated loss due to fire or flood.

In this context, risk managers should take the necessary steps to ensure their property values are fully up to date. This is critical to making sure the insurance limits they purchase will provide adequate protection in the event of a loss.

Unfortunately, the issue of underreported values has become widespread, and the impact can be devastating for any business that sustains a property loss under these circumstances. It also poses significant challenges for insurance carriers, which are focused on aggregated exposures given increasingly difficult reinsurance market conditions.

For a myriad of reasons, values have changed due to inflation, supply chain disruptions, labor shortages in construction, and generally other elements of recovery that have manifested since the Covid-19 pandemic. Simply said, values reported do not often reflect the actual cost to replace the property and this deficiency has been realized by insurance companies. This realization creates obstacles once a claim happens and the values reported and insured do not reflect the replacement costs being incurred.

– Sheri Wilson, Senior Vice President, National Property Claims Director at Lockton Companies.

Notably, when property values are underreported, it complicates the loss adjustment process for insurers and may result in inadequate recoveries for insureds and damage the relationship between the insured and carrier.

At renewal, along with more onerous policy terms and conditions associated with the current hard market, insureds may see additional price increases and coinsurance requirements, along with reduced capacity. With respect to their underwriting practices, many property insurance companies now require more frequent property appraisals as well as greater detail regarding how values are generated.

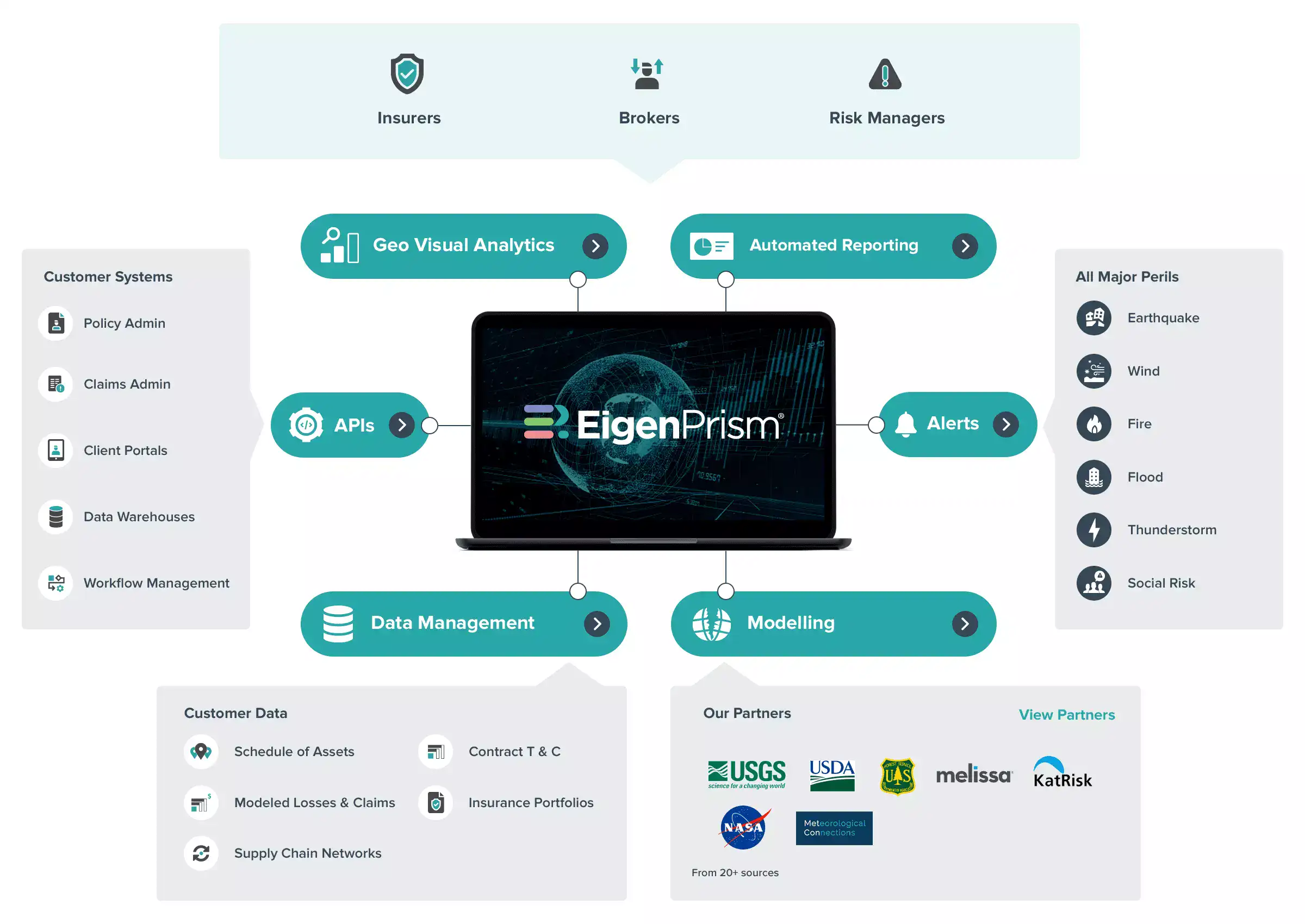

Nonetheless, for insureds with large portfolios of properties, it still may not be feasible to obtain annual appraisals of all their properties. However, costs can be mitigated by using third-party data for valuation. In addition, risk managers can use analytics to uncover potential issues and prioritize locations. For instance, using models to run year-over-year comparisons can help spot locations with outdated valuations.

Furthermore, running “what if” scenarios using current valuations can help establish priorities for obtaining new appraisals.

Given heightened underwriting requirements, insureds increasingly must be able to capture and report valuation dates. Today, the standard practice of meeting this requirement with annual snapshots that are “copied and pasted” from prior years may no longer be sufficient. Instead, new technology-based solutions that support the capturing of values over time on a property-by-property basis are proving more practical and cost-effective for insureds and more acceptable from an underwriting perspective.

With the 2024 Atlantic and Pacific Hurricane seasons upon us, risk managers need to sharpen their focus on making sure their valuations are current. The use of new technology can help make sure their values are accurate and they’re in a position to procure the appropriate level of insurance protection. In the current environment, this should be a win-win for insureds and their property carriers, alike.