Harnessing AI and Data to Revolutionize Commercial Property Underwriting

A discussion with Jason Grub, Chief Revenue Officer, Tensorflight

Despite the buzz about the potential for applications using artificial intelligence (AI) to transform the insurance industry, getting reliable results in property underwriting still calls for accessing accurate and up-to-date data about individual locations and exposures.

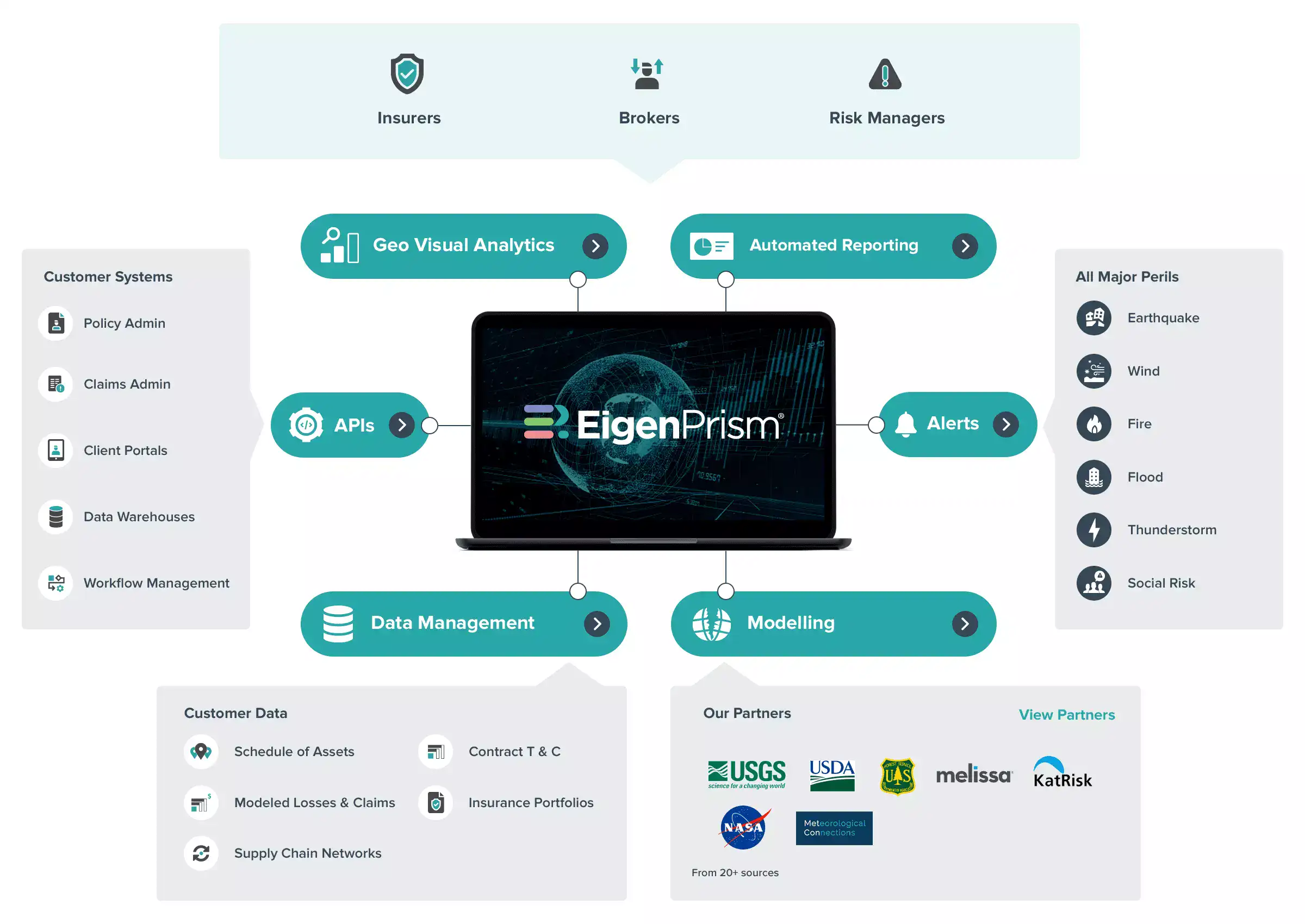

In this webinar, Jacob Grub, chief revenue officer of Tensorflight, an EigenRisk partner, discusses how Tensorflight uses AI to help insurers generate “questionless quotes” of small and middle market commercial properties throughout the U.S. Webinar host Deepak Badoni, president of EigenRisk, explains how EigenRisk clients can seamlessly apply Tensorflight insights to their underwriting decisions.

Tensorflight accesses multiple data sources in each of several different categories, such as street address, geocoding/geospatial analytics, aerial, ground-level, among other data captures, for its AI-driven models. Its powerful API then enables insurers to generate accurate quotes in seconds of single properties or thousands of locations based on real-time data that captures replacement value, COPE information, and roof analytics, including material, condition, pitch and geometry, and solar panels.

Among many other points, Grub warns about relying on single sources, such as tax assessments, for data on building footprints and square footage. By using multiple sources, Tensorflight has uncovered huge discrepancies (based on erroneous assessment data) in square footage and facility layouts, such as three buildings at a single location instead of only one building reported in the assessment.

Click below to attend the complimentary webinar and learn what it takes to get the most from AI-driven solutions for commercial property underwriting: