What The Hail! Looking Beyond Hail Scores For Smarter Underwriting and Loss Prevention

With severe convective weather outpacing all other perils combined in terms of economic damage in the U.S., 2023 was the country’s costliest year on record for hail events. Altogether, the U.S. experienced nearly 7,000 hail events last year, a dramatic increase from more than 4,400 such events in 2022.

Many of last year’s hailstorms occurred in densely populated areas, resulting in substantial economic damage. More than 22 million homes were struck by hailstones larger than .75 inches in diameter with roughly 3.5 million roofs requiring replacement.

A webinar hosted by Jon Sonnenschein, director of Business Development, EigenRisk with EigenRisk President Deepak Badoni, and Don Giuliano, president and co-founder, Canopy Weather, examined current trends in severe hailstorms as well as new developments in storm prediction and tracking that facilitate better underwriting, faster response time and more effective claims management.

Insurers brace for another active storm season. As the insurance industry emerges from last year’s costly storm-related loss events, Canopy Weather expects 2024 to be another active season for severe convective storms in the U.S. Yet, for insurers, the encouraging news is that advances in science and technology have greatly improved the ability to predict, track and assess the impact of convective storms, including major hail events.

Giuliano traced the tracking of hailstorm events and their impacts back a few decades when insurers and roofing companies depended on word of mouth and local news reports for damage information. Then, with the growing popularity of cable TV in the 1990s and launch of the Weather Channel, pending storms were able to be tracked nationally. After 2000, NOAA began providing reports online through the Internet. In 2010 hail size-maps were created and in 2020 Canopy Weather added rooftop analytics on a property-by-property basis.

Support throughout the policy life cycle. Today, Canopy can provide support for insurers, businesses and first responders throughout the policy life cycle. That begins with assessing pre-existing hail damage and evaluating climatological forecasts for underwriting purposes.

As events unfold, Canopy provides data for claims triaging and determining method of inspection to validate claims and set accurate reserves. Canopy also can prepare detailed forensic reports and deliver expert testimony based on those reports. In addition, Canopy generates roof scores to account for previous hail damage, assess vulnerability to future damage, and show insured damage from new events.

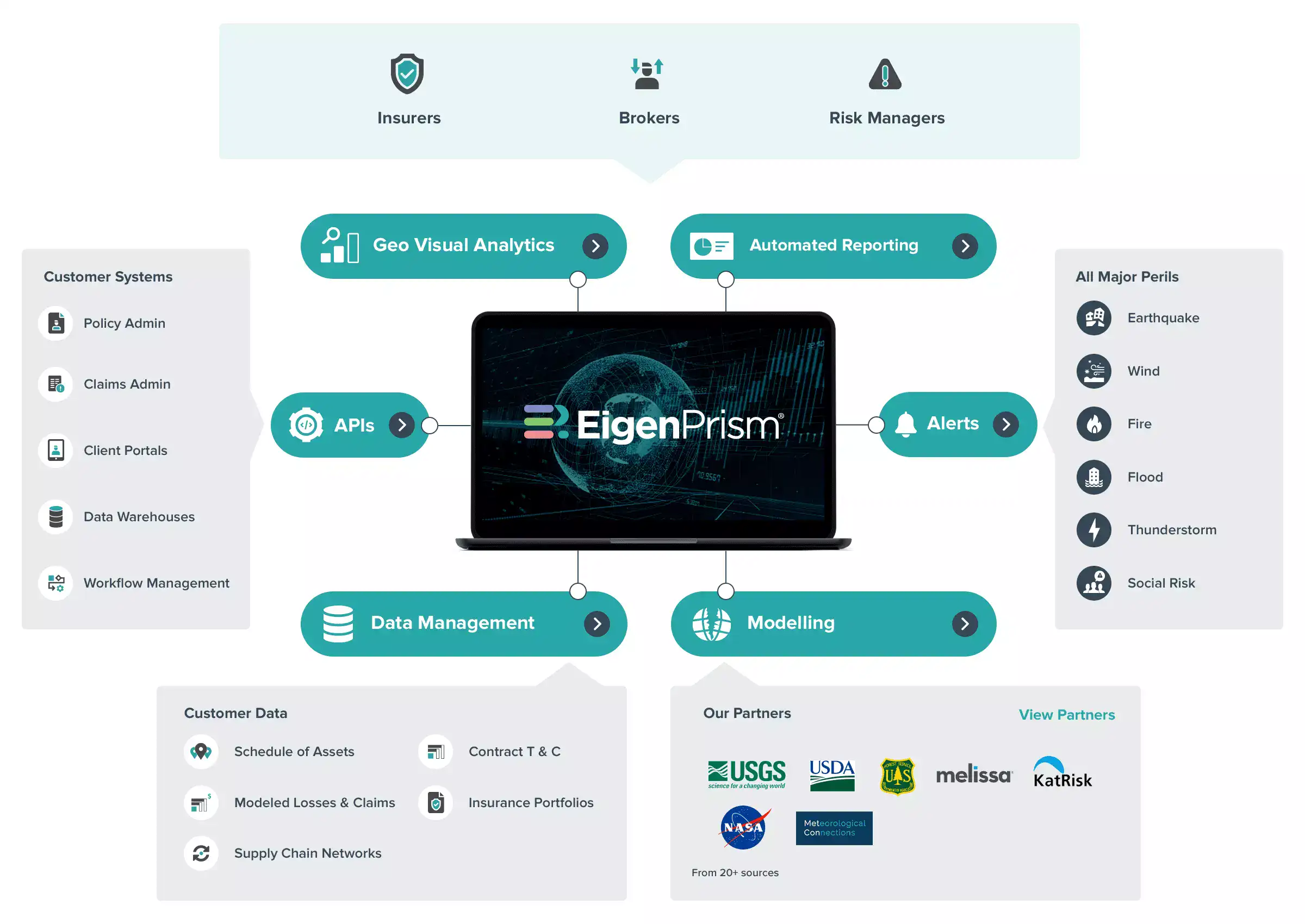

Using the EigenRisk platform, Canopy’s data can be readily accessed to deliver actionable insights for insurers to evaluate risks and impacts for individual properties, as well as for multiple sites within specific geographies and across entire portfolios. Badoni showed how users can quickly access multiple sources to identify prior damage and roof condition to develop more precise underwriting data.

Badoni also demonstrated how the EigenRisk platform can be used for hail event response, as well as tornado predication and response.

Giuliano then contrasted how Canopy hail maps differ from National Weather Storm maps based on Canopy’s ability to readily incorporate data from multiple sources. While NWS hailstorms footprints assess worst-case scenario from storms 30-minutes in advance, Canopy delivers precise footprints of what actually happened in the storm.

Badoni then provided a summary of severe convective storm datasets available on the EigenRisk platform.

Want to learn more?

To access the entire webinar, click here. To arrange a discussion and a demonstration of Canopy Weather’s hail risk evaluation, tracking and damage assessment capabilities readily accessible on the EigenRisk platform, please contact us: