How to Choose a Data Analytics Insurtech Platform for Catastrophe Risk Management

Today’s insurers, brokers, and risk managers have a lot on their plate. From building innovative products using digital transformation to engaging with customers in consultative relationships, the world of P&C insurance is changing fast. Over the last few years, data analytics has emerged as one of the fastest-growing technology investment areas. The changing climate is also a pressing concern for the insurance industry. Choosing the right data analytics platform for your insurtech stack can help you navigate catastrophe risk effectively in your organization.

The demand for digital transformation in the industry continues to grow, with emerging players raising more than $5 billion in investments in 2020. The maturity of today’s platforms makes it possible to implement a sophisticated data analytics solution with your insurtech stack.

To assist your organization with choosing a platform for data analytics to accentuate your insurance tools and technology stacks, we’ll look at everything you need to know before making your final decision.

Key Takeaways:

- With a changing digital landscape, increased threats from catastrophes, and evolving customer expectations, organizations are turning to data analytics platforms to understand and respond effectively to risks.

- Data and risk analytics insurtech platforms enable risk managers, brokers, and insurers to provide better experiences, understand risk exposure quickly, and model different what-if scenarios based on real-time data.

- When choosing a platform for your business, you’ll need a solution that remains flexible at scale and provides you with integrations to public and private data sources.

- Geo-visualizations and real-time event tracking should provide you with intelligent modeling features that help you make smarter decisions faster.

4 Features You Need in Your Data Analytics Platform for Your Insurtech Solution

Risk management professionals in the financial services industry are discovering that the digital revolution can level the playing field when it comes to offering products and services to customers. The online world is agile, responsive, and ready to capitalize on new opportunities using advanced and data-rich risk models to better position products.

Risk managers and underwriters who traditionally were sluggish to respond due to legacy systems holding them back now have an opportunity to rethink how they engage with customers. Insurtech and data analytics platforms are becoming fully fledged ecosystems that enable self-service and product personalization while delivering seamless experiences to customers and firms alike.

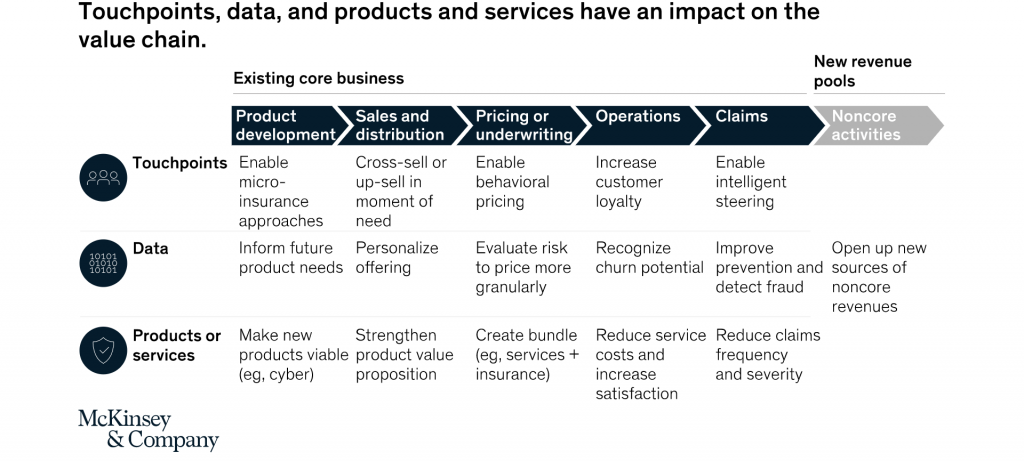

McKinsey predicts that by 2025, ecosystems (and the platforms that power them) will generate $60 trillion in global revenues. McKinsey also notes that digital touchpoints, data analysis, and product or service development will be essential for organizations to maintain market positions and generate new revenue pools.

Insurers are breaking into complementary industries, but it’s not one-way traffic. Companies like Tesla are already branching out and offering services like InsureMyTesla to customers. Unlocking new revenue pools will require a data analytics solution seamlessly integrated with your insurtech stack that quantifies risk exposure and helps future-proof your operations.

The right platform will help uncover opportunities early using the latest data that inform you about any increased catastrophe risk exposure. Below, we’ll look at four of the main features you need in a data analytics platform when integrating with your insurtech stack.

Dynamic Real-Time Data Processing Capabilities

Risk exposure and profiling require you to analyze, organize, and consume data efficiently. When choosing a platform, you’ll want a solution that provides access to real-time data processing from multiple sources, including your own datasets. Modern data analytics platforms should allow you to update attributes and collect data from different sources to suit any applicable use case.

Look for a platform that provides:

- Dynamic exposure management using integrations, manual updates, or batch processing.

- The ability to analyze data quality and validation rules to prevent non-conformant data entry.

- Support for data augmentation from a variety of sources.

- An extensible, model-agnostic data framework that enables you to define any type of exposure.

Efficient Solution Integration Using APIs

To work with current data, you’ll need a platform that connects your business workflows directly to events and risk exposure data from various sources. APIs enable you to connect your data analytics platform with your insurtech solution using internal and external data sources, modeling systems, and downstream service applications efficiently. If you can automate the update processes for exposure data, as well as the downstream servicing, modeling, and analytics tools, you’ll be able to respond to changes effectively.

Look for API integrations that:

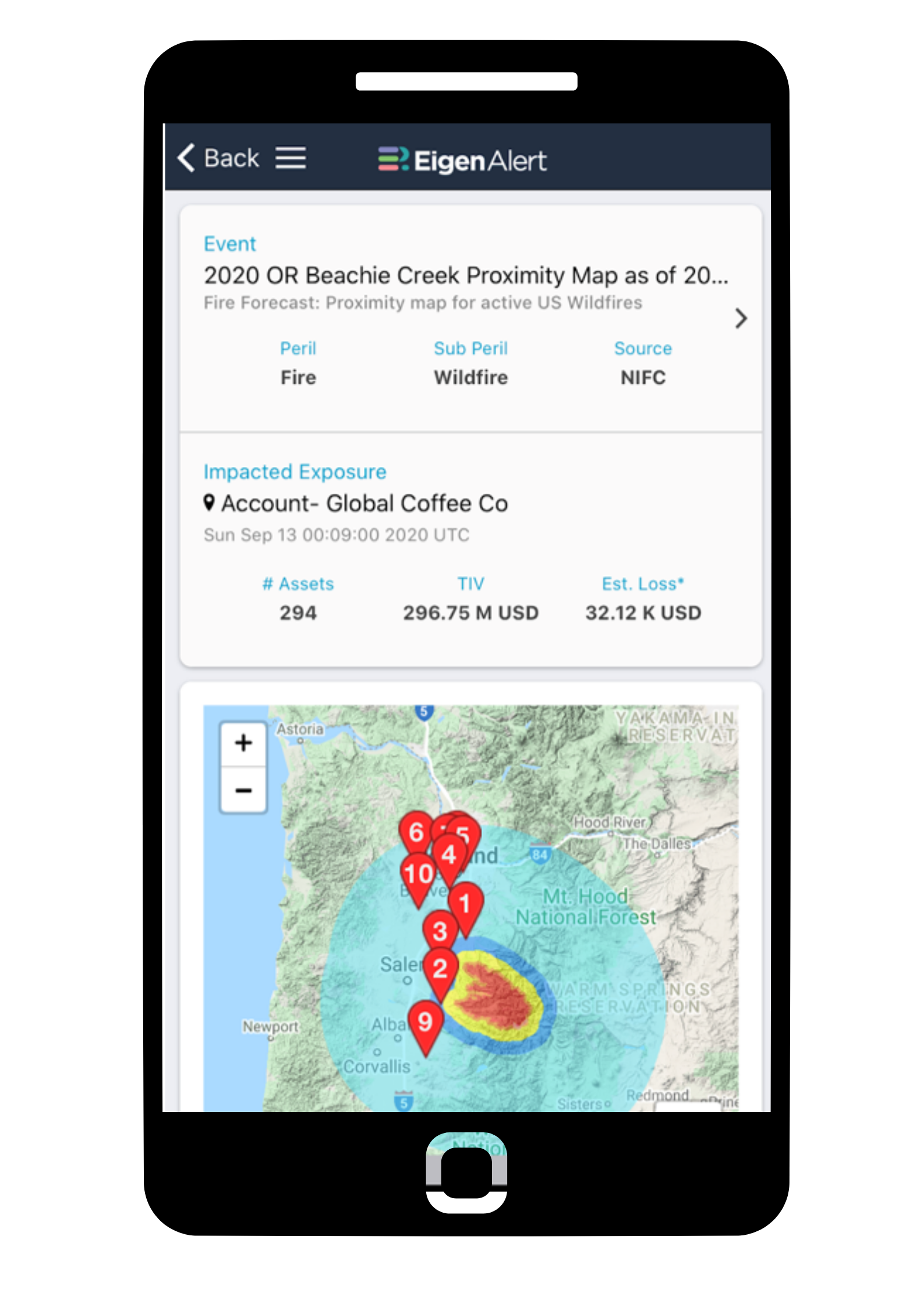

- Allow you to set up and receive real-time catastrophe event alerts based on customizable thresholds.

- Provide a rules engine to enable smarter, granular underwriting moratoriums.

- Can access an extensive library of event feeds and hazard datasets across major perils that allow you to run what-if scenarios or post-event deep dives.

Flexibility at Scale

Managing risk in your organization will require different processes inside the company to ensure everyone adheres to applicable policies, regulations, and other company-specific controls. When scaling your operations, you’ll need a workflow solution that supports your growth without compromising control.

Additionally, the data analytics platform should scale seamlessly along with your insurtech stack and provide the necessary reach, scope, and support for a diverse product range. A flexible platform can support multiple use cases according to your needs and provide you with a single source of truth for all your business processes.

Data Visualizations and Integrated Modeling

You’ll also expect access to public and private data sources that include additional hazard models for major events like earthquakes, windstorms, hail, and tornados. However, additional hazard modeling support for your own datasets and models is becoming just as important due to the changing climate risk.

When assessing your data analytics insurtech platform, verify that you can add your own hazard modeling frameworks and combine these in a single library with your own proprietary datasets and models. Improved visualizations and modeling make your loss estimates more accurate and allow you to report on potential or estimated financial impacts within minutes after a particular event.

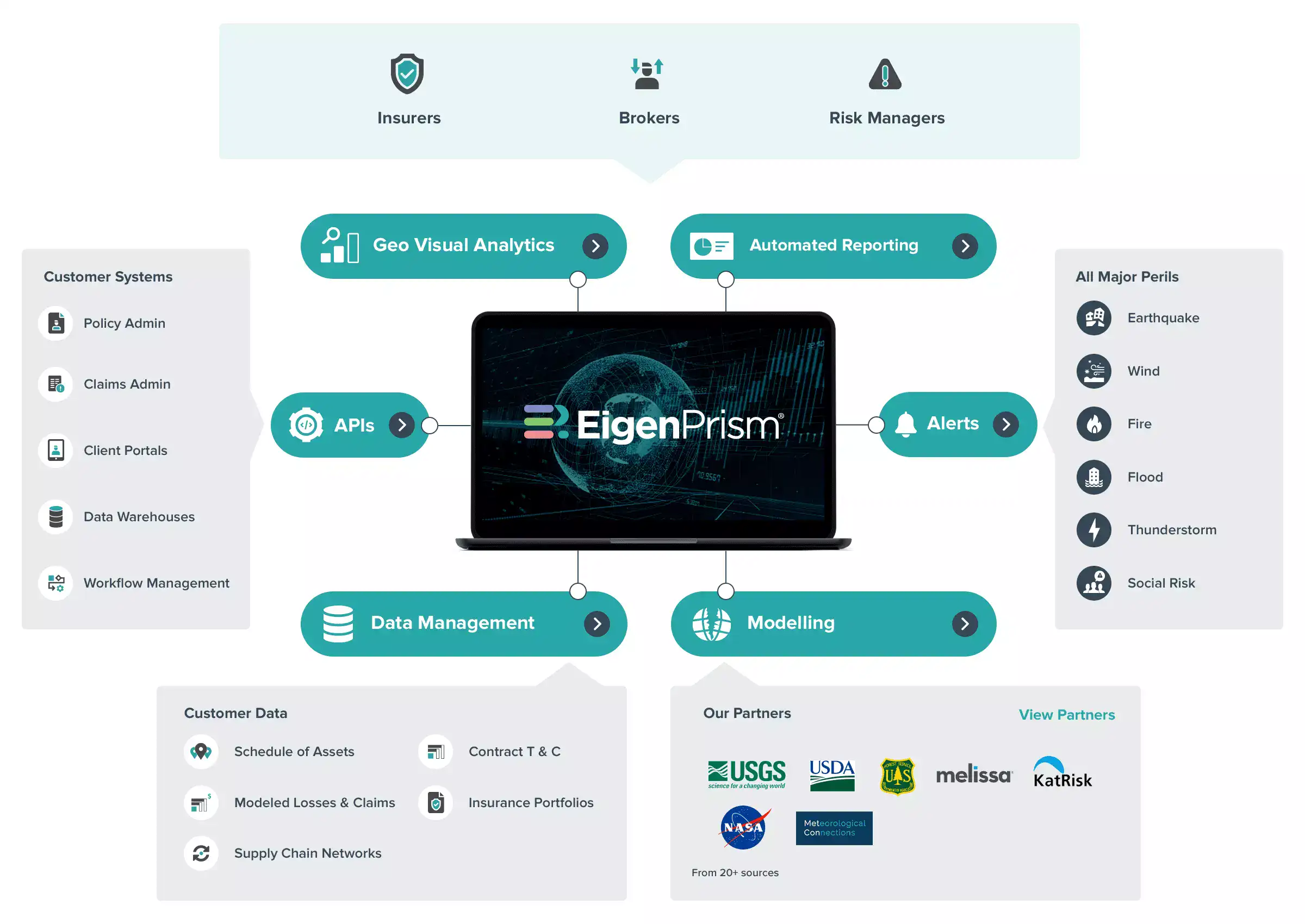

Manage Risk Effectively with the Insurtech Platform from EigenRisk

EigenRisk gives insurers, brokers, and risk managers access to powerful visualizations, real-time data, and sophisticated modeling features to optimize underwriting and exposure management processes. You can make smarter decisions faster using geo-visualizations that integrate with business intelligence rules to analyze different scenarios using our modeling engine. With a complete, one-stop solution, you can uncover new opportunities, respond to events effectively, and grow revenues without increasing risk exposure.

For more information about how EigenRisk can help streamline risk analysis and underwriting processes, request a demo from us today.