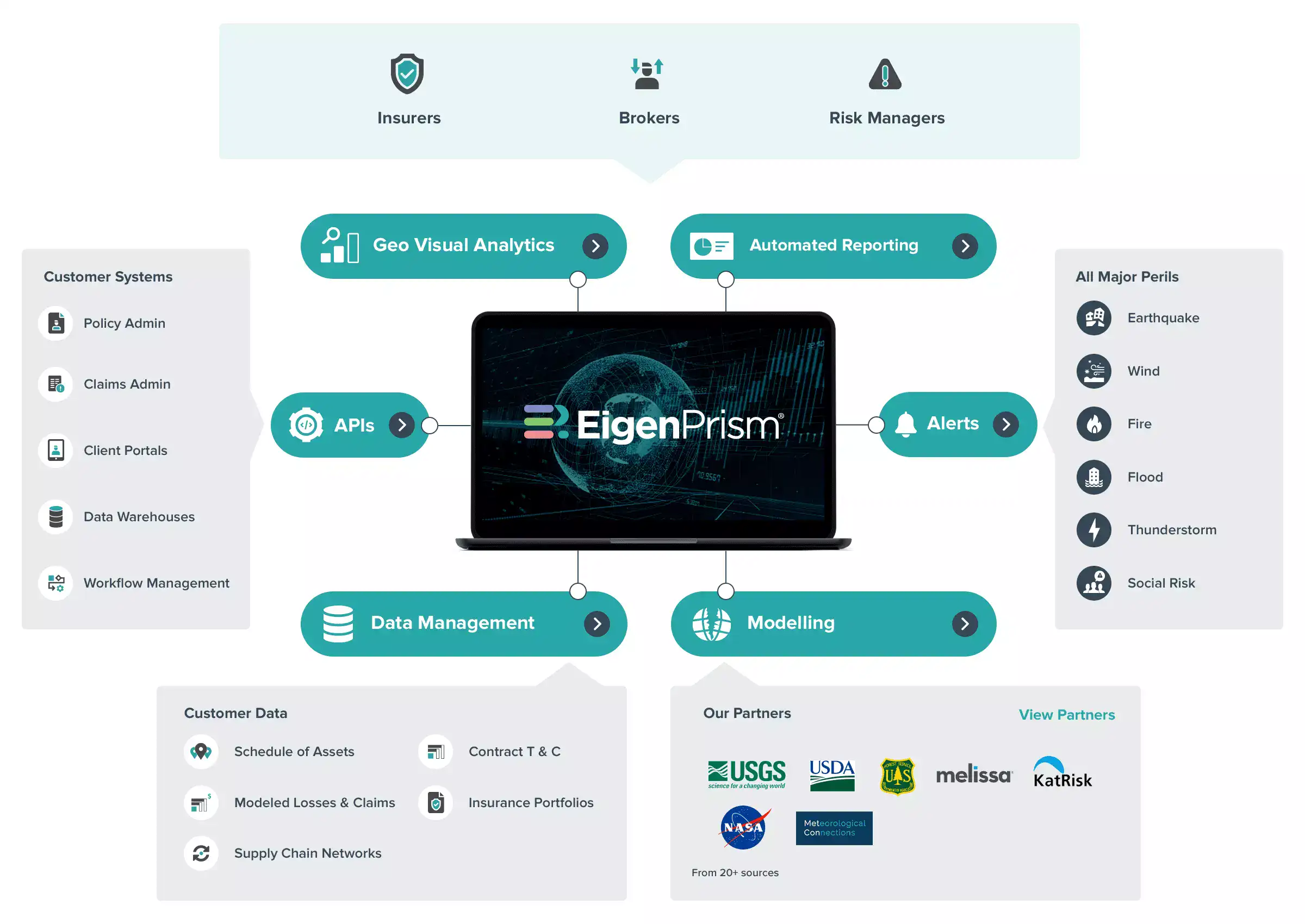

Acquire Superior Catastrophe Risk Analytics Using APIs

As natural and manmade hazards continue to grow and evolve as a threat, assessing catastrophe risks is becoming more complex for insurers. On the other hand, technology and tools available to analyze these catastrophe risks are also evolving.

So do we build new and better technology in house, or buy it from the many vendors in the InsurTech market today? – That’s often the debate when it comes to analyzing complex catastrophe risks.

In our experience, adopting a hybrid approach is becoming the way to go. A hybrid solution optimizes business decisions and helps insurers build the technology they need in-house, as well as obtain specialized technology from a third-party that they can’t build themselves. A hybrid approach leans on vendors, who are experts in the technology they produce, as a cost-effective means to build the custom technology they need and retain their competitive advantage.

APIs- A Critical Piece of the Hybrid Puzzle:

Catastrophe risk management requires sophisticated technology that goes beyond just slicing and dicing data and reporting. It requires integration of advanced geo-visualization, complex modeling calculations, and the conversion of real-time data from disparate sources.

An API is what makes integrating this third-party technology into existing systems possible. APIs infuse an insurer’s already existing technology with superior capabilities quickly. EigenPrism APIs have been created with extra layers of security to easily be integrated with the existing systems.

Our APIs address the specific and customized needs of insurers and help them transform the process of risk analysis.

Get in touch with us today, to know more about EigenPrism APIs: