Anticipating Dreaded Consequences of “Unknown Unknowns” in Global Property Catastrophe Underwriting

In 2002, as U.S. lawmakers were actively debating whether to go to war with the Republic of Iraq over its potential possession of weapons of mass destruction, the late former U.S. Secretary of Defense Donald Rumsfeld explained:

There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don’t know. But there are also unknown unknowns. There are things we don’t know we don’t know.

Today, in assessing catastrophic property exposures, insurance company underwriters must deal with a growing number of “unknown unknowns.

Certainly, property underwriters are gaining experience with what are clearly “known unknowns.” This category includes finding ways to address the changing frequency and severity of catastrophe events, such as hurricanes and wildfires, and their potential impacts on residential and commercial properties over wide areas.

While the consequences of the increasing numbers of these events may be far more costly than in the past, underwriters assessing related exposures can begin by examining established patterns over prior years and model potential impacts based on probable maximum loss (PML) calculations and other proven methodologies.

However, unknown unknowns present another set of challenges, altogether. For example, consider the devastating and deadly winter storms of 2021 in Texas, the rapid spread of the Paradise, CA wildfire, and, most recently, the wide path of destruction left by the Quad-State tornado. Indeed, global climate change in combination with significant population shifts are causing more “rare” and significant loss events that go beyond historical impacts of hurricanes and other weather events.

Today, in light of the widespread damage and loss increasingly caused by wildfires and severe convective storms, they can no longer be classified as “secondary perils” by global insurers.

Consequently, the process of underwriting catastrophe-related property exposures in an era of climate change calls for returning to the fundamentals of concentration management. Insurers might start by examining exposure data quality and concentrations instead of trying to quantify frequency and severity of events.

Underwriters can then run a series of what-if scenarios to evaluate their potential exposures with greater precision, validate their risk appetite and price exposures, accordingly. Given the dynamic nature of weather events, they can assess how their policies performed over a defined time horizon and recalibrate their catastrophe models based on the steady flow of new data.

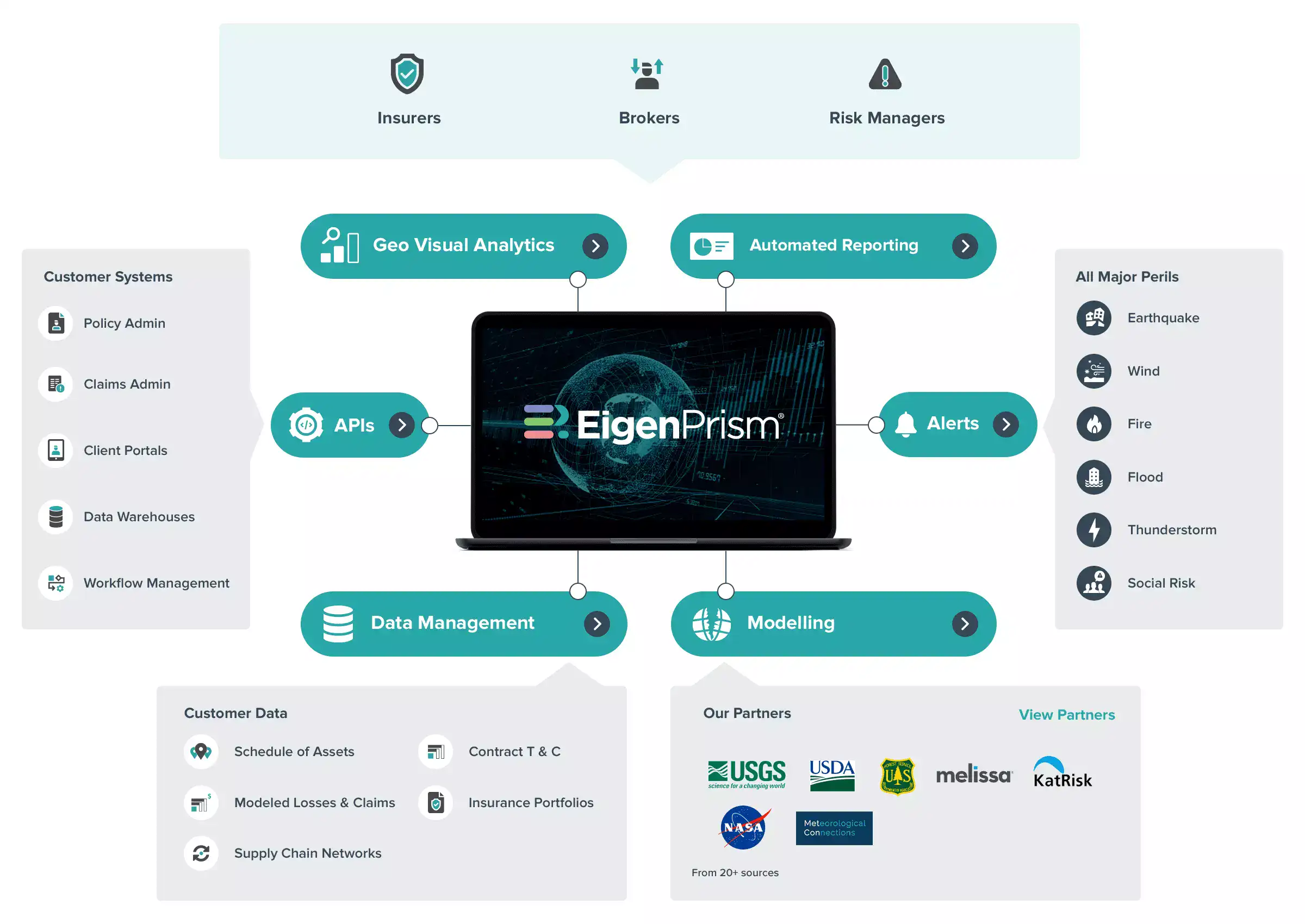

A growing number of property/casualty insurers in all parts of the world are now using the EigenRisk platform to address “known unknowns” and “unknown unknowns” with respect to potential exposures from increasingly volatile weather-related events. To learn how your company can benefit from these new resources, contact us: