The Technology Driven Property Insurance Broker

There’s no doubt that data quality substantially impacts insurance pricing and coverage. When bad data exists, the underwriters generally use worst-case assumptions. Poor data = poor pricing results and poor negotiations.

Poor data input coming from the client also requires a property broker to spend time and effort collecting, reviewing, and cleansing the data. This is a distraction for a broker who should be focused on providing value-add, consultative solutions.

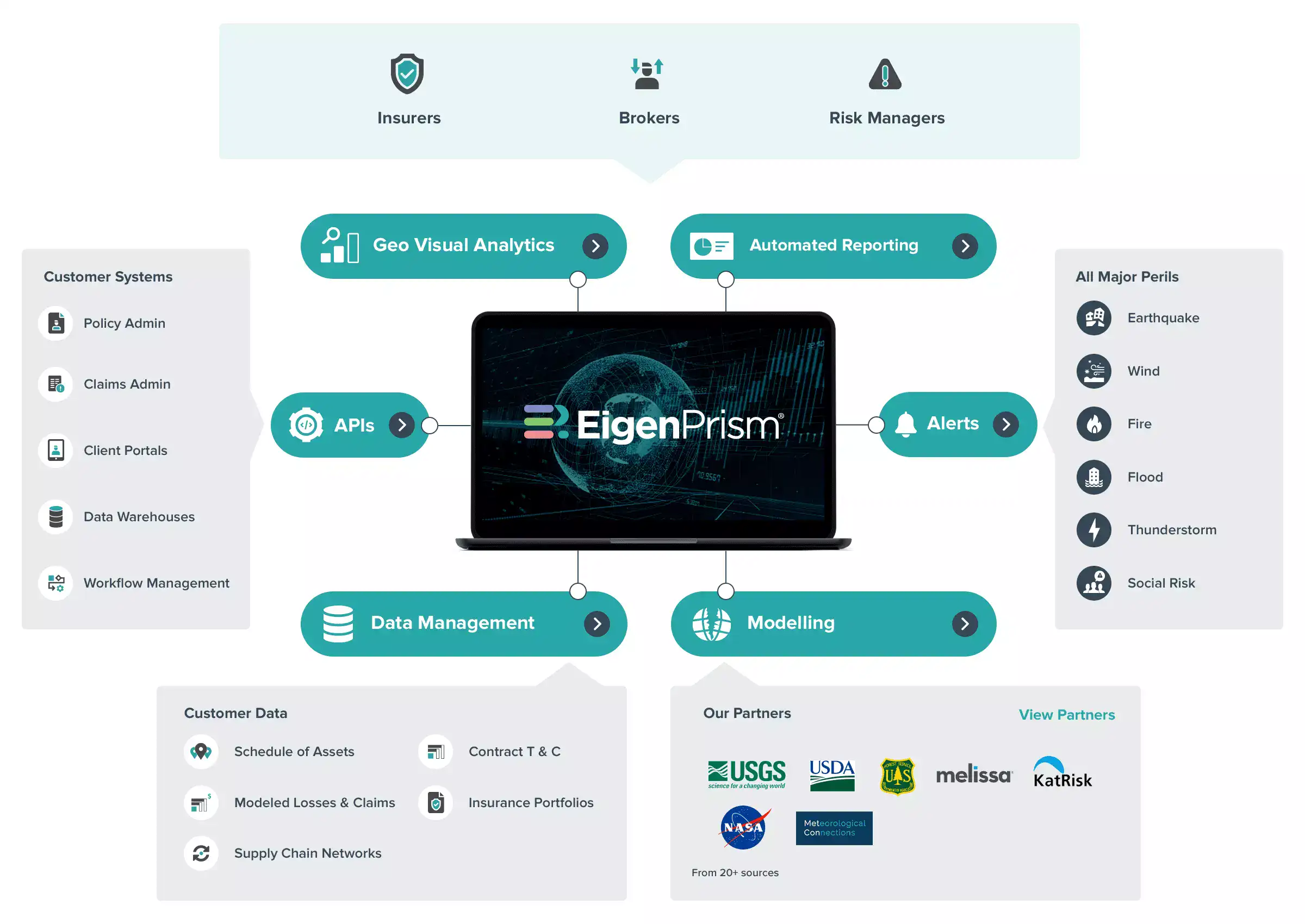

That’s where technology comes in. Technology can capture key underwriting data to fill in the gaps that normally exist for brokers and their clients, and flag potential data quality problems.

Now you’re able to have more informed discussions before going into negotiations. This can lead to a stronger insurance program structure that’s commensurate to the actual exposure and priced accurately for the risk.

To see how analytics is transforming data, download our ebook for brokers:

Visit our site to know more about: Solutions for brokers.